To normalize margins and eliminate the effects on profitability of valuing the firm at different points in the business cycle, it is usually best to take a long-term average of operating margins. Look at average margins over a business/Industry cycle: Average Operating Margin = 26.8022% "Earnings" are "Operating earnings" (EBIT).Ģ. Start with "Earnings" not including accounting adjustments (one-time charges not excluded unless policy has changed). It is arguably a better way to analyze stocks than Discounted Cash Flow analysis that relies on highly speculative growth assumptions many years into the future.Īssumption: Current profitability is sustainable.ġ. The Earnings Power Value (EPV) of Apple Inc for the quarter that ended in was 44.51.Įarnings Power Value also known as just Earnings Power is a valuation technique popularised by Bruce Greenwald, an authority on value investing at Columbia University. If 5-Year Earnings Growth Rate is greater than 25% a year, we use 25.Īpple Inc's EPS without NRI for the trailing twelve months (TTM) ended in wasįor more information about Peter Lynch fair value, visit: Peter Lynch fair value Quarterly Chart If 5-Year Earnings Growth Rate is greater than 25% a year, we use 25.ĥ-Year Earnings Growth Rate is 18.42. The growth rate we use is the average growth rate for earnings per share over the past 5 years. The earnings here is trailing twelve month (TTM) earnings.

Peter Lynch thinks that the fair PE Ratio for a growth company equals its growth rate, that is PEG = 1. The ideal range for the growth rate is between 10 - 20% a year. Peter Lynch Fair Value applies to growing companies. The Peter Lynch Fair Value of Apple Inc for the today is 108.49.

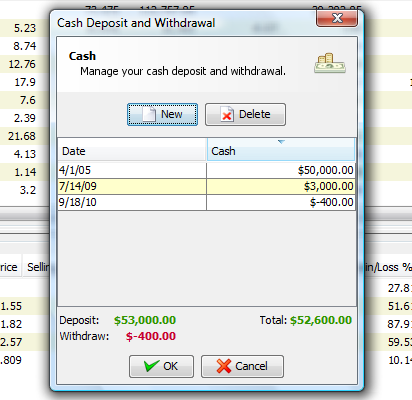

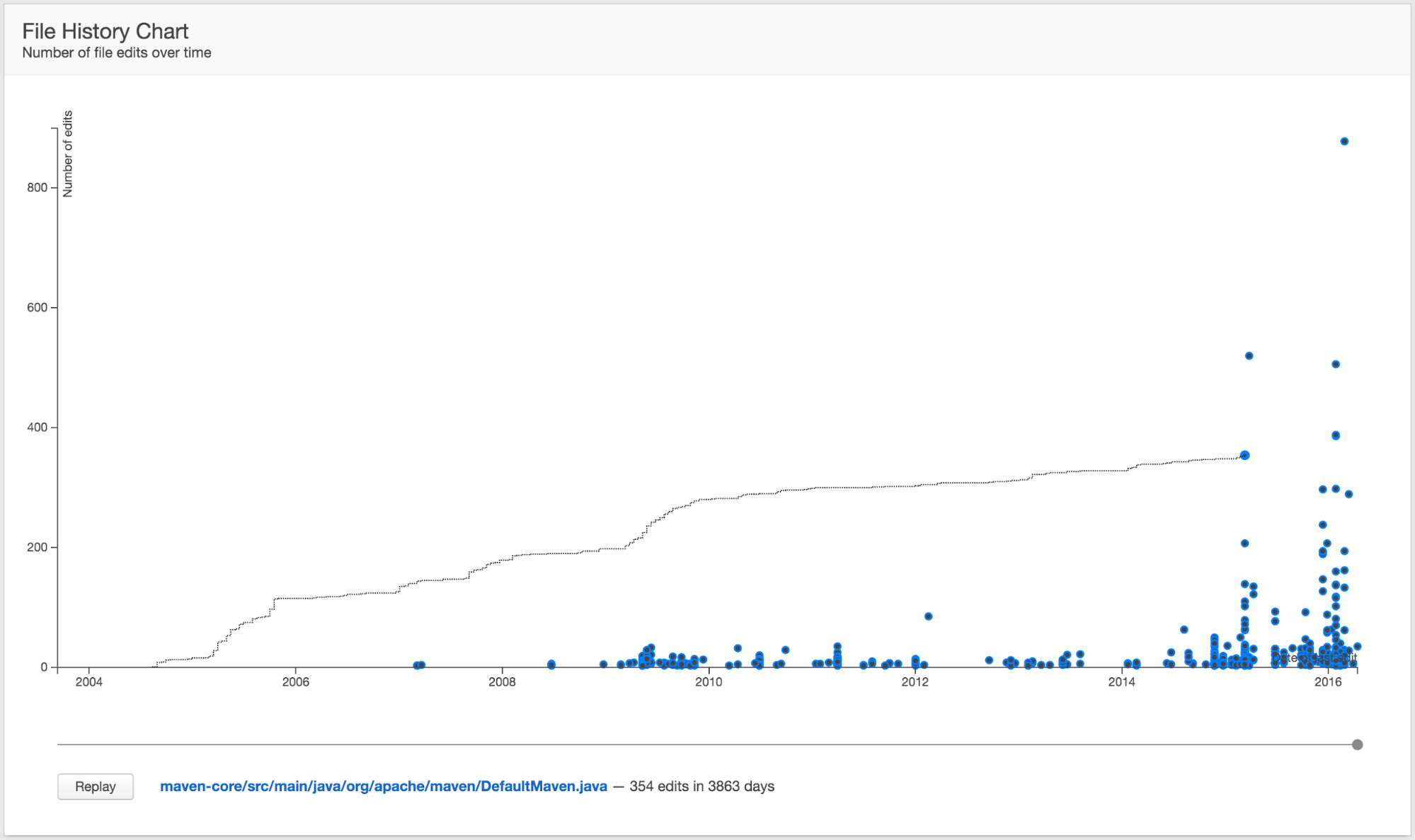

History chart not available in jstock free#

Here Apple Inc' s FCF(6 year avg) is calculate asĪdd all the Free Cash Flow together and divide 6 will get Apple Inc FCF(6 year avg) = 76,492.67Īpple Inc's Intrinsic Value: Projected FCF for today is calculated asĪpple Inc's Free Cash Flow Growth Multiple is 14.86.įor more information about Intrinsic Value: Projected FCF, visit: Intrinsic Value: Projected FCF Quarterly Chart Value = ((Growth Multiple)* Free Cash Flow(6 year avg) + Total Equity(most recent)/0.8)/ Shares Outstanding Calculation In the case of negative total equity, the following formula is used (see the Total Equity section for the reason): Value = ((Growth Multiple)* Free Cash Flow(6 year avg) + 0.8* Total Equity(most recent))/ Shares Outstanding This method smooths out the free cash flow over the past 6-7 years, multiplies the results by a growth multiple, and adds a portion of total equity. The details of how we calculate the intrinsic value of stocks are described here. Or Discounted Earnings (DCE) Intrinsic Value: DCF (Earnings Based)Ĭannot be applied to companies without consistent revenue and earnings, GuruFocus developed a valuation model based on normalizedįree Cash Flow and Book Value of the company. Since the intrinsic value calculations based on Discounted Cash Flow Intrinsic Value: DCF (FCF Based), The Intrinsic Value: Projected FCF of Apple Inc for today is 74.1.

This is a conservative way of estimating the company's value.įor more information about NNWC, visit: Net-Net Working Capital Quarterly Chart In "Security Analysis", preferred stock is dubbed "an imperfect creditorship position" that is best placed on the balance sheet alongside funded debt. In addition, Graham believed that preferred stock belongs on the liability side of the balance sheet, not as part of capital and surplus. In calculating the Net-Net Working Capital (NNWC), Benjamin Graham assumed that a company's accounts receivable is only worth 75% its value, its inventory is only worth 50% of its value, but its liabilities have to be paid in full. The Net-Net Working Capital of Apple Inc for the quarter that ended in was $ -13.73.

0 kommentar(er)

0 kommentar(er)